Owner

Medicare

Made Easy

Confused by Medicare choices and requirements? Our experienced team of insurance agents offers tailored guidance, helping you secure the right plan effortlessly and at the best possible deal.

Our Current Blogs

📈 Medigap Premiums Are Going Up—Here’s Why (and What You Can Do About It) Many of our clients are receiving letters this spring announcing

steep Medicare Supplement (Medigap) rate increases for summer 2025

—mine went up 14%! If you’re seeing the same, you’re not alone. But let’s break down why this is happening and what you can do to take control.

💡 Why Are Rates Increasing So Much This Year?

Beyond the usual rise in healthcare costs, this year’s increase is also driven by three key COVID-19-related factors

Catch-Up in Medical Usage: During the height of the pandemic, many people delayed routine doctor visits, surgeries, and checkups. Now that the dust has settled, providers are busier than ever—causing a spike in claims.

Post-Pandemic Claims Surge: Insurers initially saw lower claims during COVID and even offered premium relief in some areas. But the rebound in medical activity has pushed claims up significantly, and insurers are adjusting rates accordingly.

Economic Ripple Effects: COVID led to early retirements and tighter budgets for many. While that doesn't directly change premiums, it makes increases harder to manage—and adds urgency to finding better options.

🔄 You Can Shop New Coverage at Any Time

One of the biggest myths we hear is: “I thought I could only change plans during Open Enrollment.” That’s not true for Medicare Supplement plans

You can shop new coverage any time of year—and for many of you, you’ll qualify for a better rate through underwriting.

💰The sooner you lower your rate, the more you save over time—thanks to the compounding effect of starting from a lower base premium.

Attention, Carolinians approaching the Big 6-5! Are you ready to flip the calendar to a new chapter? As you approach this remarkable milestone, it’s crucial to get savvy about your Medicare choices!

If you're nestled in the heart of the Carolinas and about to celebrate your 65th birthday, let's chat about how you can make the most out of your golden years.

It's time to navigate the seas of Medicare together, ensuring that your health care sails smoothly into retirement. I'm here to be your guide through the maze of Medicare options.

Whether it's understanding the ins and outs of Medicare Advantage, unraveling the mysteries of Medigap, or simply getting a grip on Medicare Supplements – I've got you covered! Retiring should be about enjoying life, not fretting over paperwork and policy details. Let’s talk Social Security benefits and how they play with your healthcare coverage so that you can focus on what really matters – living your best life post-65!

Here’s what we’ll explore together: The ABCs (and D) of Medicare Tailoring Medicare Advantage plans to fit YOUR lifestyle The security blanket that Medigap provides Maximizing benefits with Medicare Supplements Don't let this opportunity slip by! Ensure peace of mind knowing that when it comes to healthcare, you're as prepared as can be.

Reach out now and let’s secure your future with confidence! Drop me a message or give me a call – I'm here for all my fellow Carolinians turning 65 soon. Let’s get smart about your Medicare options together!

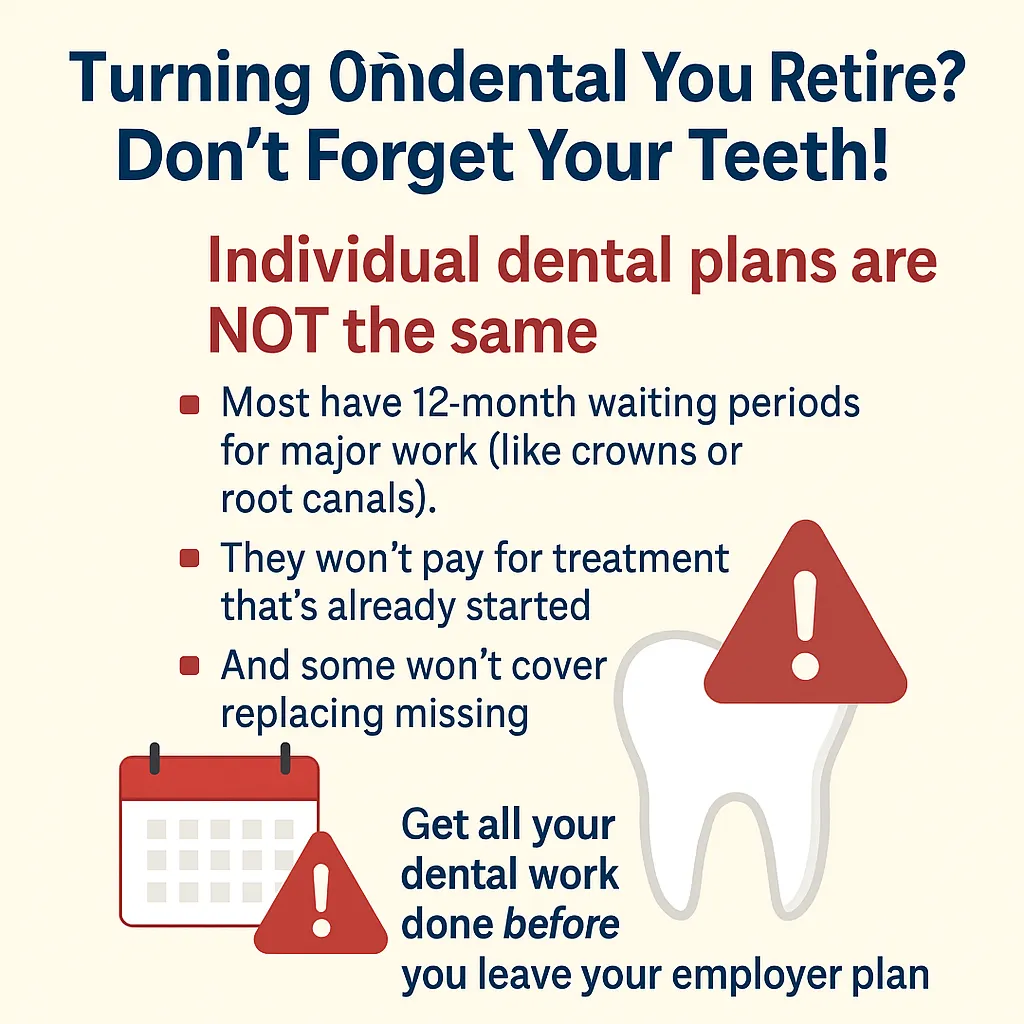

Turning 65 Soon? Don’t Wait on Dental Work Before You Retire

If you're turning 65 and still working, you’re in a unique position—and there’s an important dental insurance message you need to hear before you retire.

Most people enjoy great dental benefits through their employer. But here’s the catch: once you leave that job, your coverage goes with it. And individual dental insurance? It plays by a very different set of rules.

Don’t Wait—Get That Dental Work Done Now

If you’re even thinking about retirement in the next year or two, you should be thinking about your teeth now. Why? Because once you lose your employer-sponsored plan, replacing it with an individual dental policy comes with some serious limitations:

1. Waiting Periods Can Delay Your Care

Most individual dental plans have 12-month waiting periods for major services. That means if you need a crown, a bridge, or a root canal, your new plan may not pay for it for an entire year. Here’s a quick breakdown of how dental insurance generally works:

Preventive Services– cleanings, exams, X-rays. Usually covered right away and often at 100%.

Basic Services– fillings, simple extractions, some periodontal work. These may have a short or no waiting period, but coverage often starts lower (like 80%).

Major Services– crowns, bridges, dentures, root canals. These typically come with that dreaded12-month waiting period.

2. No Coverage for Work in Progress

Let’s say you’ve already started a crown or a bridge under your employer plan. If you retire before it’s finished and switch to an individual plan—you’re on the hook for the rest. Most individual dental plans will not cover work that started before the policy went into effect.

3. The Missing Tooth Clause

Planning on getting an implant or a bridge for a tooth you lost years ago? Many individual dental policies have a missing tooth clause, which means they won’t pay to replace teeth that were already missing before you got the policy.

Personal Note: Don’t Let This Happen to You

I recently had a tooth pulled, fully expecting to follow up with more treatment. But my coverage ends before that work can be done. Now I’m facing a long waiting period under my new plan—and a much bigger out-of-pocket bill.

The Bottom Line

If you’re turning 65 and planning to retire soon, make dental care a priority before your coverage ends. Schedule a full dental checkup and get any needed work done while you’re still covered by your employer’s plan.It could save you thousands—and a lot of dental headaches down the road.

To Be Published

About Us

Helping You To

Manage Your Medicare Needs!

With a lifelong background in service—from flying helicopters in the U.S. Army to a 25-year career as a commercial airline pilot—I’ve always believed in doing what’s right and helping others. After retiring from aviation, I returned to the insurance world to focus on Medicare, where I guide clients with honesty, clarity, and a no-pressure approach. At Anderson Medicare Group, we specialize in helping veterans, airline personnel, and retirees navigate Medicare with confidence. Our mission is simple: put clients first and always do what’s best for them.

John Anderson

Owner

NPN: 1894224

About Us

Helping You To

Manage Your Medicare Needs!

With a lifelong background in service—from flying helicopters in the U.S. Army to a 25-year career as a commercial airline pilot—I’ve always believed in doing what’s right and helping others. After retiring from aviation, I returned to the insurance world to focus on Medicare, where I guide clients with honesty, clarity, and a no-pressure approach. At Anderson Medicare Group, we specialize in helping veterans, airline personnel, and retirees navigate Medicare with confidence. Our mission is simple: put clients first and always do what’s best for them.

John Anderson

Owner

1894224

Everything You Need To Know About Medicare

At A Glance

What Is Medicare?

Medicare is a federal health insurance program

for people 65 and older, certain younger individuals with disabilities, and those with End-Stage Renal Disease.

Am I Eligible?

Determine your eligibility for Medicare by assessing factors such as age, disability status, and specific medical conditions like End-Stage Renal Disease.

Coverage Options

Explore the diverse Medicare coverage options available to ensure you receive the comprehensive healthcare benefits tailored to your unique needs.

Everything You Need To Know About Medicare

At A Glance

What Is Medicare?

Medicare is a federal health insurance program

for people 65 and older, certain younger individuals with disabilities, and those with End-Stage Renal Disease.

Am I Eligible?

Determine your eligibility for Medicare by assessing factors such as age, disability status, and specific medical conditions like End-Stage Renal Disease.

Coverage Options

Explore the diverse Medicare coverage options available to ensure you receive the comprehensive healthcare benefits tailored to your unique needs.

Reviews

Real-Life Testimonials

From Satisfied Clients

More Info

Product Descriptions

Stand-alone Medicare Prescription Drug Plans (Part D)

Medicare Prescription Drug Plan (PDP) : A stand-alone drug plan that adds prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-for-Service Plans, and Medicare Medical Savings Account Plans.

Medicare Advantage Plans (Part C) and Cost Plans

Medicare Health Maintenance Organization (HMO): A Medicare Advantage Plan that provides all Original Medicare Part A and Part B health coverage and sometimes covers Part D prescription drug coverage. In most HMOs, you can only get your care from doctors or hospitals in the plan’s network (except in emergencies).Medicare Preferred Provider Organization (PPO) Plan: A Medicare Advantage Plan that provides all Original Medicare Part A and Part B health coverage and sometimes covers Part D prescription drug coverage. PPOs have network doctors and hospitals but you can also use out-of-network providers, usually at a higher cost.Medicare Private Fee-For-Service (PFFS) Plan: A Medicare Advantage Plan in which you may go to any Medicare-approved doctor, hospital and provider that accepts the plan’s payment, terms and conditions and agrees to treat you – not all providers will. If you join a PFFS Plan that has a network, you can see any of the network providers who have agreed to always treat plan members. You will usually pay more to see out-of-network providers.Medicare Point of Service (POS) Plan: A type of Medicare Advantage Plan available in a local or regional area which combines the best feature of an HMO with an out-of-network benefit. Like the HMO, members are required to designate an in-network physician to be the primary health care provider. You can use doctors, hospitals, and providers outside of the network for an additional cost.Medicare Special Needs Plan (SNP): A Medicare Advantage Plan that has a benefit package designed for people with special health care needs. Examples of the specific groups served include people who have both Medicare and Medicaid, people who reside in nursing homes, and people who have certain chronic medical conditions.Medicare Medical Savings Account (MSA) Plan: MSA Plans combine a high deductible health plan with a bank account. The plan deposits money from Medicare into the account. You can use it to pay your medical expenses until your deductible is met.Medicare Cost Plan: In a Medicare Cost Plan, you can go to providers both in and out of network. If you get services outside of the plan’s network, your Medicare-covered services will be paid for under Original Medicare but you will be responsible for Medicare coinsurance and deductibles.Medicare Medicaid Plan (MMP): An MMP is a private health plan designed to provide integrated and coordinated Medicare and Medicaid benefits for dual eligible Medicare beneficiaries.

Dental/Vision/Hearing Products

Plans offering additional benefits for consumers who are looking to cover needs for dental, vision or hearing. These plans are not affiliated or connected to Medicare

Hospital Indemnity Products

Plans offering additional benefits; payable to consumers based upon their medical utilization; sometimes used to defray copays/coinsurance. These plans are not affiliated or connected to Medicare.

Medicare Supplement (Medigap) Products

Plans offering a supplemental policy to fill “gaps” in Original Medicare coverage. A Medigap policy typically pays some or all of the deductible and coinsurance amounts applicable to Medicare-covered services, and sometimes covers items and services that are not covered by Medicare, such as care outside of the country. These plans are not affiliated or connected to Medicare.

Looking for a First-Class Medicare Consultant?

Looking for a First-Class Medicare Consultant?

Anderson Medicare Group is committed to serving you at the highest level with all your Medicare needs.

National Producer Number: 1894224

DISCLAIMER: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Company

Directories

Legal

Anderson Medicare Group is committed to serving you at the highest level with all your Medicare needs.

National Producer Number: 1894224

DISCLAIMER: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Company

Directories

Legal